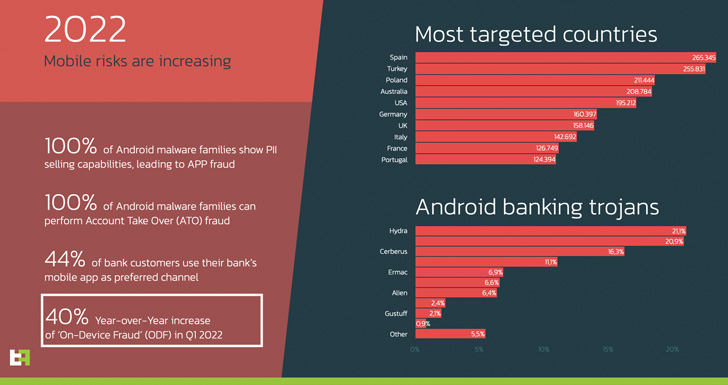

An analysis of the mobile threat landscape in 2022 shows that Spain and Turkey are the most targeted countries for malware campaigns, even as a mix of new and existing banking trojans are increasingly targeting Android devices to conduct on-device fraud (ODF).

Other frequently targeted countries include Poland, Australia, the U.S., Germany, the U.K., Italy, France, and Portugal.

“The most worrying leitmotif is the increasing attention to On-Device Fraud (ODF),” Dutch cybersecurity company ThreatFabric said in a report shared with The Hacker News.

“Just in the first five months of 2022 there has been an increase of more than 40% in malware families that abuse Android OS to perform fraud using the device itself, making it almost impossible to detect them using traditional fraud scoring engines.”

Hydra, FluBot (aka Cabassous), Cerberus, Octo, and ERMAC accounted for the most active banking trojans based on the number of samples observed during the same period.

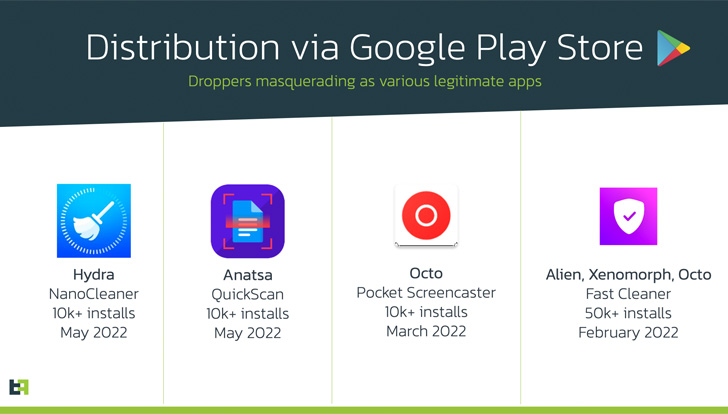

Accompanying this trend is the continued discovery of new dropper apps on Google Play Store that come under the guise of seemingly innocuous productivity and utility applications to distribute the malware –

- Nano Cleaner (com.casualplay.leadbro)

- QuickScan (com.zynksoftware.docuscanapp)

- Chrome (com.talkleadihr)

- Play Store (com.girltold85)

- Pocket Screencaster (com.cutthousandjs)

- Chrome (com.biyitunixiko.populolo)

- Chrome (Mobile com.xifoforezuma.kebo)

- BAWAG PSK Security (com.qjlpfydjb.bpycogkzm)

What’s more, on-device fraud — which refers to a stealthy method of initiating rogue transactions from victim’s devices — has made it feasible to use previously stolen credentials to login to banking applications and carry out financial transactions.

To make matters worse, the banking trojans have also been observed constantly updating their capabilities, with Octo devising an improved method to steal credentials from overlay screens even before they are submitted.

“This is done in order to be able to get the credentials even if [the] victim suspected something and closed the overlay without actually pressing the fake ‘login’ present in the overlay page,” the researchers explained.

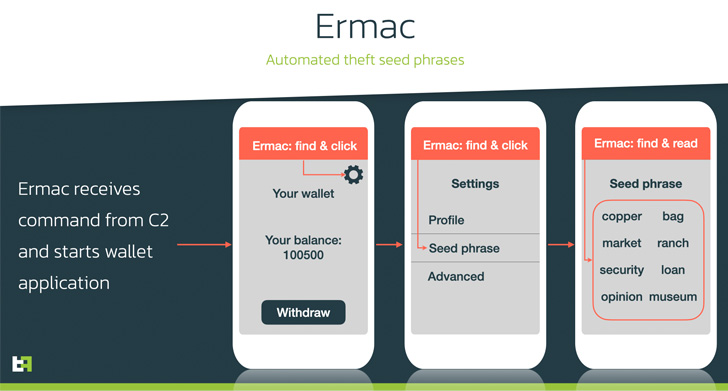

ERMAC, which emerged last September, has received noticeable upgrades of its own that allow it to siphon seed phrases from different cryptocurrency wallet apps in an automated fashion by taking advantage of Android’s Accessibility Service.

Accessibility Service has been Android’s Achilles’ heel in recent years, allowing threat actors to leverage the legitimate API to serve unsuspecting users with fake overlay screens and capture sensitive information.

Last year, Google attempted to tackle the problem by ensuring that “only services that are designed to help people with disabilities access their device or otherwise overcome challenges stemming from their disabilities are eligible to declare that they are accessibility tools.”

But the tech giant is going a step further in Android 13, which is currently in beta, by restricting API access for apps that the user has sideloaded from outside of an app store, effectively making it harder for potentially harmful apps to misuse the service.

That said, ThreatFabric noted it was able to bypass these restrictions trivially by means of a tweaked installation process, suggesting the need for a more stricter approach to counteract such threats.

It’s recommended that users stick to downloading apps from the Google Play Store, avoid granting unusual permissions to apps that have no purpose asking for them (e.g., a calculator app asking to access contact lists), and watch out for any phishing attempts aimed at installing rogue apps.

“The openness of Android OS serves both good and bad as malware continues to abuse the legitimate features, whilst upcoming restrictions seem to hardly interfere with the malicious intentions of such apps,” the researchers said.